Description

Xylene (C8H10): A Key Petrochemical in Industry and Beyond

Key Points on Xylene

- Chemical Nature: Xylene, with the formula C8H10, is an aromatic hydrocarbon existing in three main isomers—ortho-, meta-, and para-xylene—each with slightly different properties but shared uses as solvents and feedstocks.

- Common Applications: It plays a vital role in paints, adhesives, and as a raw material for plastics like PET bottles, though demand varies by isomer.

- Market Growth: The global xylene market is projected to expand steadily, driven by Asia-Pacific’s industrial boom, with estimates suggesting growth from around $58-85 billion in 2025 to over $100 billion by the early 2030s.

- Health and Environmental Concerns: While useful, xylene can irritate skin and eyes, and long-term exposure may affect the nervous system; regulations emphasize safe handling to minimize risks.

- Future Outlook: Demand appears likely to rise with packaging and construction needs, but shifts toward sustainable alternatives could influence its role in petrochemicals.

What is Xylene?

Xylene is a colorless, flammable liquid widely used in the chemical industry. It consists of three isomers that differ in the position of methyl groups on a benzene ring, affecting their specific applications.

Primary Xylene Uses

In everyday products, xylene serves as a solvent in paints and coatings, helping them dry evenly. It’s also key in producing plastics for bottles and clothing.

Global Xylene Market Overview

Asia leads production and consumption, fueled by rapid urbanization. Other regions like the Middle East contribute through oil refining.

Safety and Regulatory Notes

Handling xylene requires protective gear to avoid irritation. Environmental rules aim to limit emissions, reflecting its potential to contaminate air and water.

Xylene, chemically known as dimethylbenzene with the formula C8H10, stands as a cornerstone in the petrochemical sector. This aromatic hydrocarbon, derived primarily from crude oil refining, exists in three structural isomers: ortho-xylene (o-xylene), meta-xylene (m-xylene), and para-xylene (p-xylene). Each isomer shares core physical traits—a clear, colorless appearance, flammability, and a characteristic sweet odor—but differs slightly in melting and boiling points, influencing their industrial handling and applications. Commercial xylene often appears as a mixture containing 40-65% m-xylene and up to 20% each of o- and p-xylene, along with ethylbenzene.

The compound’s low density (0.86-0.88 g/mL) makes it lighter than water, and it is practically insoluble in water while highly soluble in non-polar solvents like other aromatics. Its odor threshold in air ranges from 0.08 to 3.7 ppm, and it can be detected in water at 0.53 to 1.8 ppm. Xylene forms azeotropes with water and alcohols, aiding in certain separation processes. Viscosity varies by isomer, with o-xylene at 0.812 cP (20°C), m-xylene at 0.62 cP (20°C), and p-xylene at 0.34 cP (30°C).

Production of xylene occurs through catalytic reforming of petroleum naphtha and coal carbonization, often as part of the BTX aromatics (benzene, toluene, xylene) stream. Advanced processes like UOP-Isomar or zeolite-catalyzed transalkylation adjust isomer ratios to favor high-demand p-xylene. Naturally, xylene occurs in crude oil at 0.5-1% concentrations and traces in gasoline and aircraft fuels. Discovered in 1850 from wood tar by French chemist Auguste Cahours, its industrial scale now reaches millions of tons annually.

Xylene Uses in Industry

Xylene’s versatility shines in its role as a solvent and chemical intermediate. As a solvent, it features in printing inks, rubber processing, leather treatments, and adhesives, where it replaces toluene for slower evaporation in paints and varnishes. In the petroleum sector, it dissolves paraffins, while in electronics, it cleans steel, silicon wafers, and circuits. Dentistry employs it to dissolve gutta percha in root canals.

Laboratory applications include dry ice cooling baths, microscope oil removal, and histology clearing to extract paraffin from tissue slides. As a feedstock, p-xylene dominates, converting to terephthalic acid and dimethyl terephthalate for PET plastics and polyester fibers—accounting for 98% of its use and half of all xylene production. O-xylene yields phthalic anhydride for resins and plastics, while m-xylene produces isophthalic acid for alkyd resins, though lower demand often leads to its conversion to other isomers.

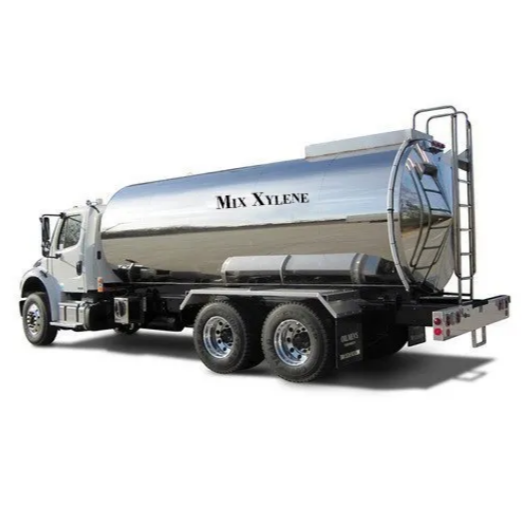

Mixed xylene enhances gasoline octane and serves in paints, coatings, sealants, and adhesives for construction and automotive sectors. Its high solvency supports applications in monomers for plastics and synthetic fibers.

| Isomer | Key Xylene Uses | Primary End Products |

|---|---|---|

| Ortho-xylene | Phthalic anhydride production | Plastics, resins, coatings |

| Meta-xylene | Isophthalic acid synthesis | High-performance polymers, aerospace coatings |

| Para-xylene | Terephthalic acid for PET | Polyester fibers, bottles, packaging |

| Mixed xylene | Solvents, fuel additives | Paints, adhesives, gasoline blending |

Global Xylene Market Trends and Key Producing Regions

The xylene market reflects robust growth in petrochemicals, with 2024 valuations around $62.87 billion, projected to reach $75.9 billion by 2029 at a 4.3% CAGR. Alternative estimates peg 2025 at $85.85 billion, growing to $115.92 billion by 2032 at the same CAGR. For mixed xylene, 2025 is estimated at $58.2 billion, expanding to $104.1 billion by 2035 at 5.1% CAGR.

Asia-Pacific dominates with over 56% share in 2024, valued at $46.27 billion, led by China (6.1% CAGR) and India through industrialization and polyester production. The Middle East follows as the fastest-growing, bolstered by oil giants like Saudi Aramco. North America benefits from automotive and packaging demand, while Europe emphasizes regulations and advanced manufacturing in Germany and France. Key players include ExxonMobil, Sinopec, Reliance Industries, and BASF.

Trends include capacity expansions, bio-based innovations, and CO2-derived p-xylene. Demand drivers encompass PET packaging, infrastructure, and high-octane fuels.

| Region | 2025 Market Share Estimate | Key Drivers | CAGR Projection |

|---|---|---|---|

| Asia-Pacific | ~56% | Urbanization, polyester demand | 5-6% |

| Middle East | Second-largest | Oil refining expansions | Fastest growth |

| North America | Significant | Automotive, packaging | 4.8% (USA) |

| Europe | Steady | Regulations, manufacturing | 3-4% |

Health and Safety Considerations for Xylene

Xylene poses toxicity risks, primarily through inhalation causing eye, nose, and throat irritation, nausea, and neurological impairments like dizziness and memory issues. Acute dermal contact leads to skin dryness and scaling, while chronic exposure affects the CNS, causing headaches, fatigue, and potential kidney issues. Animal studies highlight liver, kidney, and developmental effects.

Safe handling mandates ventilation, spark-proof tools, and PPE like gloves and respirators. Exposure limits include OSHA PELs and NIOSH RELs, with EPA’s RfD at 2 mg/kg/day. ATSDR’s chronic inhalation MRL is 0.4 mg/m³.

Environmental and Regulatory Aspects

Xylene disperses widely in air, water, and soil, with urban air levels up to 0.38 mg/m³ and drinking water under 2 μg/L. It volatilizes quickly but can contaminate groundwater. Ecological risks include potential harm to aquatic life, though persistence is low.

EPA classifies it as Group D (not classifiable for carcinogenicity). Regulations cover occupational limits via OSHA, ACGIH, and NIOSH, plus environmental standards for emissions and waste. Global efforts focus on VOC reductions.

Demand Outlook and Future Role in Global Petrochemicals

Xylene demand is poised for growth, fueled by PTA/PET production for packaging and textiles, alongside solvents in construction. Emerging markets in Asia drive this, with innovations in refining and sustainable processes. Challenges like raw material volatility and environmental scrutiny may spur bio-based shifts, but xylene’s integral role in petrochemicals ensures sustained relevance through 2035.

| Year | Mixed Xylene Market Size (USD Billion) | Overall Xylene Market Size (USD Billion) | Key Growth Factor |

|---|---|---|---|

| 2025 | 58.2 | 85.85 | PET demand rise |

| 2029 | N/A | 75.9 | Capacity expansions |

| 2032 | N/A | 115.92 | Urbanization |

| 2035 | 104.1 | N/A | Fuel blending norms |

Reviews

There are no reviews yet.