Top Shipping Routes for Middle East Petrochemical Exports (2025 Guide)

Introduction

The Middle East is the heart of global petrochemical exports, with countries like Iran, Saudi Arabia, and the UAE playing dominant roles in supplying polymers, solvents, and base oils to international buyers. As demand for products like PE100B, monoethylene glycol, and SN150 base oil continues to rise, shipping routes have become a decisive factor in cost, delivery speed, and global competitiveness.

Understanding the top shipping routes for Middle East petrochemical exports is essential for buyers, traders, and suppliers looking to optimize trade in 2025. This article explores the most important export routes, freight cost dynamics, and the future of petrochemical logistics in the region.

1. Persian Gulf to Asia: The Core Trade Lane

Asia, particularly China, India, and Southeast Asia, remains the largest importer of Middle Eastern petrochemicals. Products like PE100B and monoethylene glycol are in constant demand for the construction, automotive, and textile sectors.

Main Route: Persian Gulf ports (Bandar Abbas, Jebel Ali, Jubail) → Arabian Sea → Indian Ocean → South China Sea.

Transit Time: ~18–25 days (depending on destination).

Key Buyers: China, India, Vietnam, Indonesia, Bangladesh.

Challenges: Seasonal freight spikes, port congestion in Singapore and India.

2. Persian Gulf to Europe: The Mediterranean Connection

European markets rely on Middle Eastern petrochemicals for plastic resins, solvents, and lubricants. Iran and Saudi Arabia are key suppliers of PE and PP grades, solvents like Solvesso 100, and base oils like SN150.

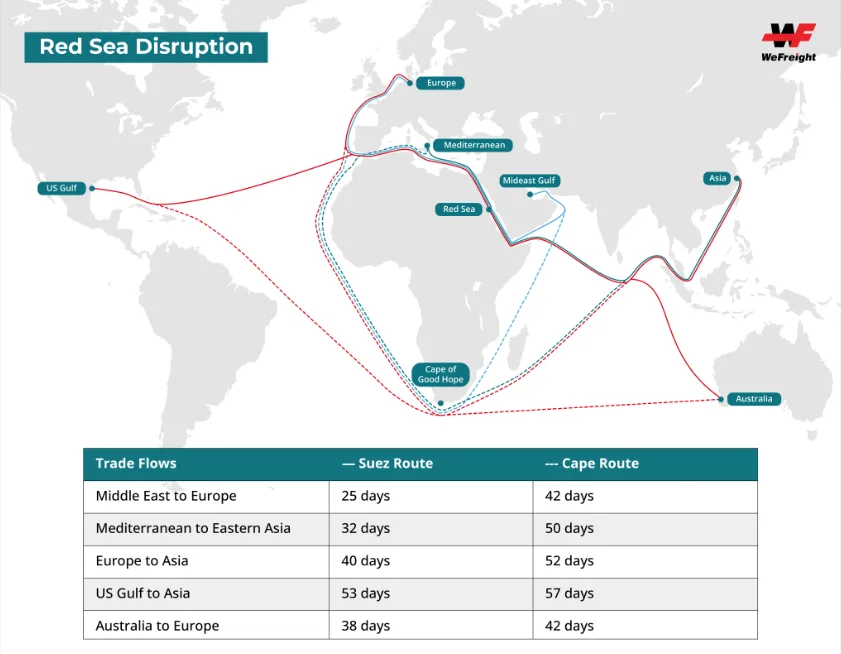

Main Route: Persian Gulf → Suez Canal → Mediterranean ports (Italy, Spain, Turkey, Greece).

Transit Time: ~20–30 days.

Key Buyers: Turkey (as both importer & re-exporter), Italy, Spain.

Challenges: Rising Suez Canal tolls, energy transition policies in Europe.

3. Persian Gulf to Africa: Emerging Market Opportunities

Africa is becoming a growing consumer of petrochemicals, especially in construction (HDPE pipes), automotive lubricants, and packaging materials.

Main Route: Persian Gulf → Red Sea → East Africa (Kenya, Tanzania, Ethiopia).

Alternative Route: Persian Gulf → West Africa via Cape of Good Hope (Nigeria, Ghana).

Transit Time: 14–28 days depending on East or West Africa.

Key Buyers: Kenya, Nigeria, Egypt, South Africa.

Challenges: Infrastructure gaps, fluctuating freight costs.

4. Persian Gulf to CIS Countries: Overland & Rail Links

The CIS region (Central Asia, Russia, Caucasus) represents a special market since exports can flow by rail and road in addition to sea routes.

Main Route: Overland trucking via Iran → Azerbaijan → Russia.

Alternative: Iran’s Chabahar Port → multimodal rail link to Central Asia.

Key Buyers: Uzbekistan, Kazakhstan, Russia.

Transit Time: Faster for nearby countries (~5–12 days).

Challenges: Border regulations, sanctions, and seasonal weather disruptions.

5. Future Trends in Petrochemical Shipping Routes

Shift toward Asia: China and India will remain the backbone of Middle East exports.

Sanctions & Geopolitics: May force exporters like Iran to use alternative ports and re-routing.

Sustainability & Green Shipping: IMO regulations may raise costs for older vessels.

Digitalization of Freight: Exporters increasingly rely on freight marketplaces for competitive shipping rates.

Comparative Table: Major Shipping Routes for Middle East Petrochemicals

| Route | Key Buyers | Transit Time | Main Products | Challenges |

|---|---|---|---|---|

| Persian Gulf → Asia | China, India, Vietnam | 18–25 days | PE100B, MEG, solvents | Freight spikes, port congestion |

| Persian Gulf → Europe | Turkey, Italy, Spain | 20–30 days | Base oil SN150, Solvents | Suez tolls, EU regulations |

| Persian Gulf → Africa | Kenya, Nigeria, Egypt | 14–28 days | HDPE, lubricants | Weak infrastructure |

| Overland to CIS | Russia, Kazakhstan, Uzbekistan | 5–12 days | PE, PP, solvents | Border issues, sanctions |

FAQs

Q1: Which route is most cost-effective for PE100B exports?

Asia routes via the Indian Ocean are most cost-efficient due to large volumes and established trade lanes.

Q2: How do logistics affect monoethylene glycol price?

Freight costs directly impact the monoethylene glycol price, especially in Asia where demand is high.

Q3: What risks do exporters face when shipping to Europe?

High Suez Canal fees, EU carbon regulations, and stricter quality compliance.

Q4: Can African markets absorb more petrochemicals in the future?

Yes. With infrastructure growth, Africa could become a major demand hub by 2030.

Asia is the largest and most cost-effective export destination for Middle East petrochemicals.

Europe remains important but is heavily influenced by regulations and canal tolls.

Africa shows strong growth potential but requires logistics investment.

CIS routes provide flexibility via land and multimodal trade.

Looking for suppliers in Iran?

- Contact Us today and get connected with producers and export-ready logistics.

- sales@PetroExportHub.com

Related posts

Mono Ethylene Glycol (MEG) serves as a cornerstone for modern antifreeze and coolant formulations, offering reliable freezing protection and heat resi . . .

Explore Solvent 100’s specs, uses, and export opportunities from Iran. Ideal for paint, ink, and adhesive buyers in India, Turkey, UAE, and Africa. . . .

Explore everything you need to know about exporting sulphur from Iran in 2024 — including types, packaging, documents, ports, prices, and top import . . .

Explore Iran’s top ports for petrochemical exports, including Bandar Imam Khomeini, Assaluyeh, and Bandar Abbas. Compare infrastructure, accessibili . . .

Learn the key differences between polypropylene (PP) and polyethylene (PE), their applications, advantages, and how to choose the right polymer for yo . . .

Discover how a Turkish plastics manufacturer reduced costs by 22% through importing HDPE from Iran. Real-world case study by PetroExportHub. . . .

Learn why Iran is a leading exporter of polyethylene (PE). Discover grades, global applications, and how PetroExportHub connects buyers with top suppl . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality