Archive Articles

- Ask an Expert

- Export Guides

- Market Trends

- Product Comparison

- Shipping & Packaging

- Trade Compliance

- Uncategorized

Exporting PE100B resin comes with multiple supply chain challenges, including high freight costs, regulatory hurdles, and currency risks. Buyers face the impact through higher PE100B export prices and potential shipment dela . . .

Iran is emerging as a strong contender in the PE100B export market, leveraging its low-cost production and growing petrochemical capacity. The country’s location gives it an advantage in supplying Asia and Africa quickly a . . .

Middle Eastern petrochemical exports rely heavily on shipping routes to Asia, Europe, Africa, and CIS regions. Asia remains the top buyer of PE100B and monoethylene glycol, while Europe demands solvents and base oils. Africa . . .

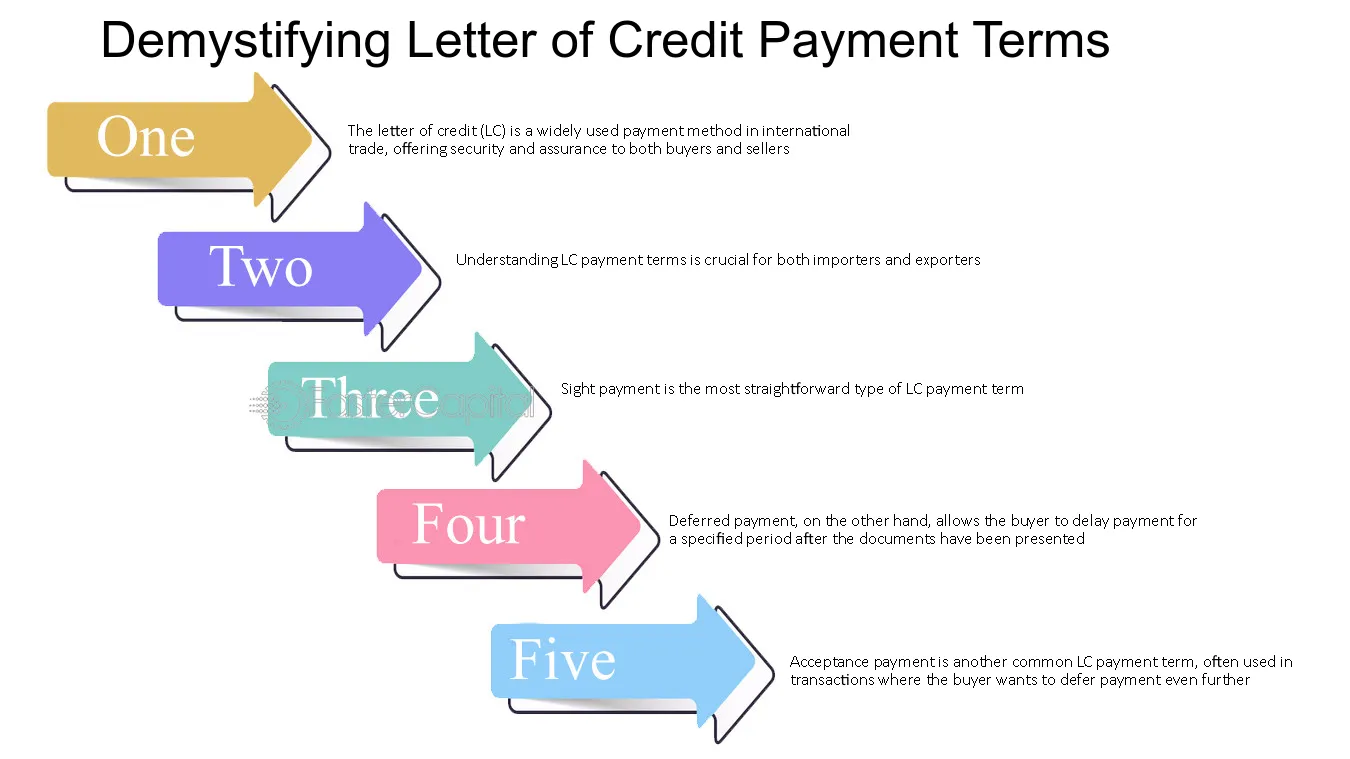

Letters of Credit are essential tools for managing financial risk in petrochemical exports. They guarantee secure payments for exporters of PE100B, SN150 base oil, and monoethylene glycol. Different types of LCs exist, inclu . . .

Incoterms 2025 set the global standard for responsibilities in international trade. For petrochemical exporters of PE100B, SN150 base oil, and MEG, using the right Incoterm prevents costly disputes. FOB, CFR, CIF, and DAP re . . .

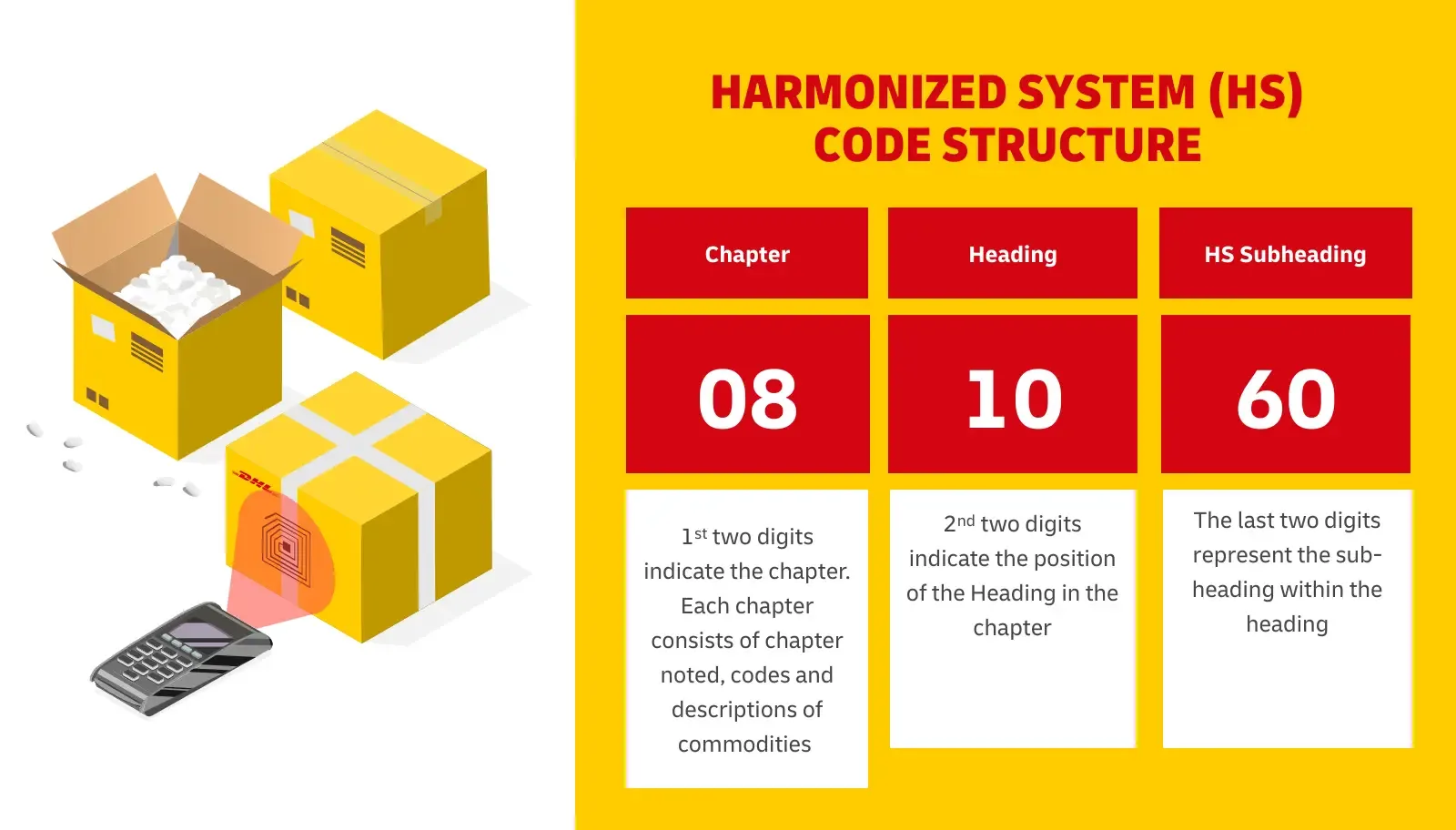

HS codes are the backbone of customs classification in chemical and petrochemical exports. They determine tariffs, compliance, and clearance efficiency. Exporters of MEG, PE100B, and base oil SN150 must ensure precise classi . . .

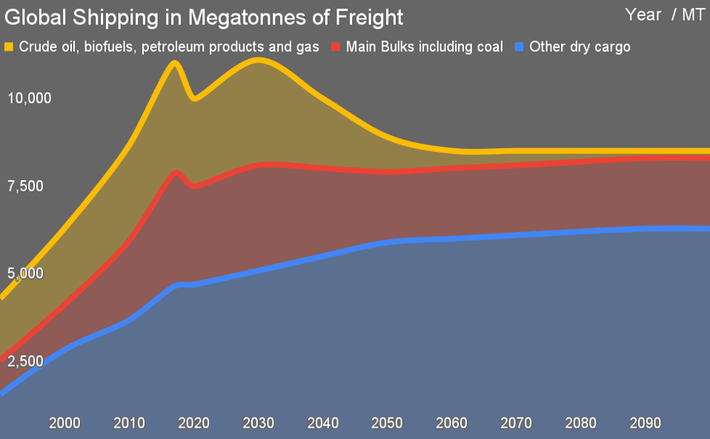

Freight costs are among the most critical factors shaping the competitiveness of petrochemical exports worldwide. From Iran to Asia, Europe, and Africa, fluctuations in shipping charges directly influence petrochemical price . . .

The Bill of Lading is the backbone of international petrochemical trade. It acts as a receipt, contract, and title document, ensuring smooth delivery and payment. Choosing the right type of B/L is critical for exports of PE1 . . .