Archive Articles

- Ask an Expert

- Export Guides

- Market Trends

- Product Comparison

- Shipping & Packaging

- Trade Compliance

- Uncategorized

Petrochemical exporters face hidden costs that reduce profitability, including insurance premiums, demurrage charges, and port delays. These costs can add up to 12% of shipment value. Insurance is unavoidable but manageable . . .

Africa presents a meaningful and growing market for petrochemical exporters willing to adapt commercial models. PE100B demand is rising with infrastructure projects; base oil SN150 finds steady industrial and automotive use; . . .

The Middle East hosts some of the world’s top petrochemical export ports, including Jebel Ali (UAE), Jubail (Saudi Arabia), Bandar Abbas (Iran), Hamad (Qatar), and Sohar (Oman). These ports provide specialized storage, bul . . .

South Asia’s booming industries, from textiles to construction, are driving record demand for petrochemical imports. India and Bangladesh lead the region, importing large volumes of polyethylene, polypropylene, and MEG. Fo . . .

India’s demand for polyethylene imports continues to rise, with projections of 5+ million tons by 2025. Key suppliers include Saudi Arabia, Iran, and the UAE, supported by low freight costs and strategic trade routes. For . . .

Currency fluctuations directly affect petrochemical export pricing, altering profit margins and competitiveness. A stronger USD raises landed costs for importers, while exporters face risks if their local currency strengthen . . .

The EV revolution is reshaping petrochemical demand worldwide. From battery electrolytes to lightweight plastics and synthetic rubbers, petrochemicals are indispensable in EV manufacturing. Exporters in regions like the Midd . . .

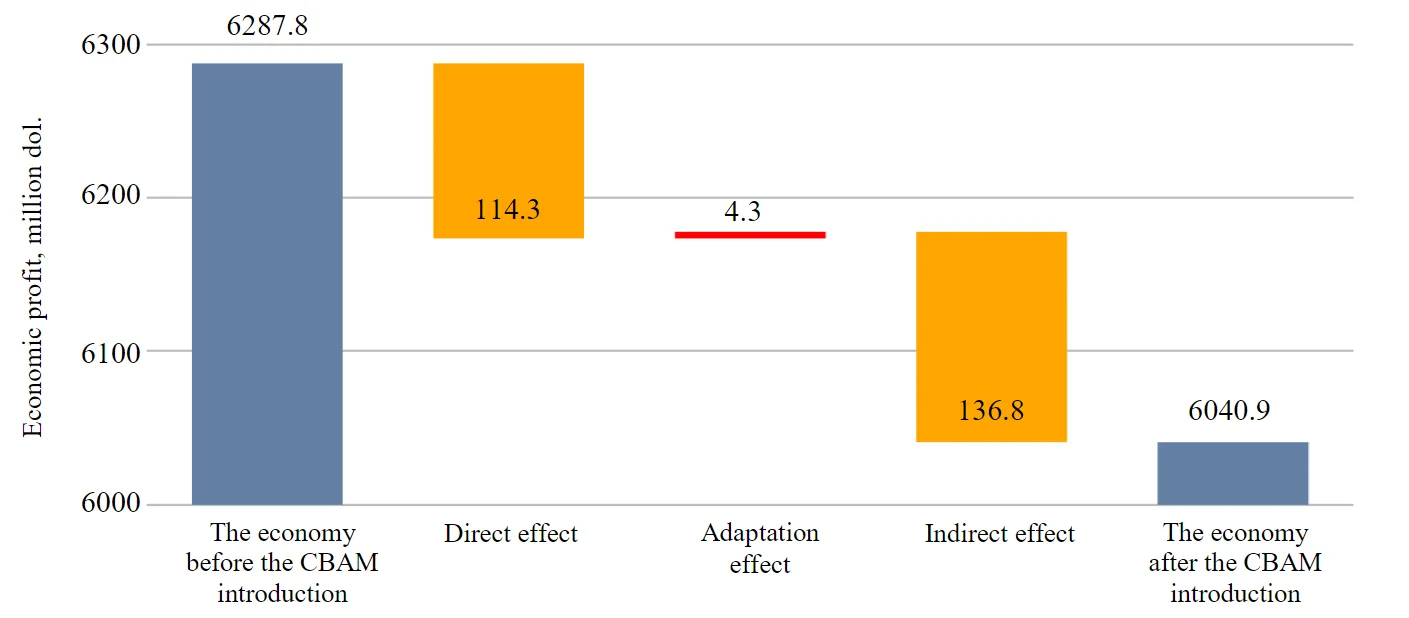

The EU’s CBAM is a game-changer for petrochemical exports, adding costs for carbon-intensive products like PE, PP, and MEG. Exporters in the Middle East and Asia will face pricing pressure, compliance challenges, and poten . . .