Archive Articles

- Ask an Expert

- Export Guides

- Market Trends

- Product Comparison

- Shipping & Packaging

- Trade Compliance

- Uncategorized

The monoethylene glycol market in 2025 will be shaped by crude oil trends, logistics costs, and regional demand patterns. Asia-Pacific demand will remain the strongest, while the Middle East continues to offer cost advantage . . .

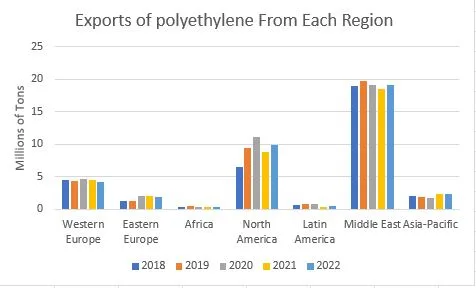

The future of PE100B in global markets looks promising. With competitive PE100B pipe price, adherence to international PE100B pipe specifications, and reliable PE100B suppliers, the Middle East is set to strengthen its posit . . .

Iran’s entry into the Asian pipeline market is more than just a pricing story. With globally recognized PE100B pipe specifications, competitive PE100B pipe price in Asia, and reliable Iran PE100B suppliers, the country is . . .

The PE100B export price is no longer determined only by resin production costs—it is heavily influenced by freight and logistics. As PE100B resin suppliers adapt to rising challenges, buyers are advised to evaluate not jus . . .

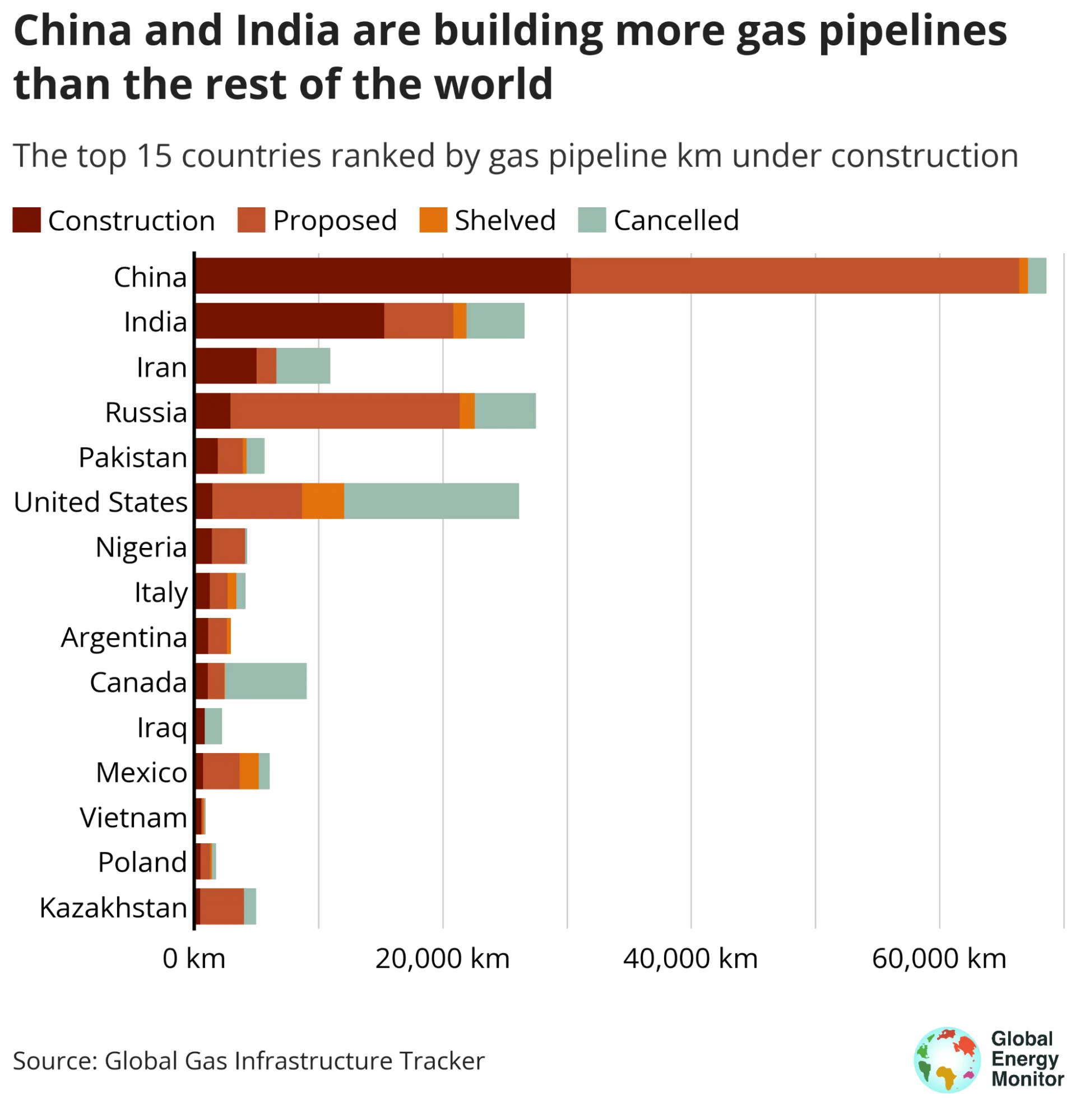

In 2025, the United States leads global imports of PE piping, closely followed by Iraq and major European markets like France and Germany. Rapid urbanization sees Asia-Pacific—especially China and India—maintaining high . . .

The PE100B export price in 2025 is shaped by crude oil fluctuations, logistics, and regional demand. Asia remains the largest importer, benefiting from competitive shipping costs, while Europe pays higher premiums due to str . . .

PE100B export regulations are reshaping trade flows, especially in Europe and Asia. Europe enforces strict PE100B compliance standards like EN 12201 and REACH, making it a high-cost but premium market. Asia, while more flexi . . .

Exporting PE100B resin comes with multiple supply chain challenges, including high freight costs, regulatory hurdles, and currency risks. Buyers face the impact through higher PE100B export prices and potential shipment dela . . .