Solvesso 100 Price Trends: What’s Shaping Global & Regional Markets in 2025

As we move through 2025, the Solvesso 100 price is under the spotlight for formulators and procurement teams across the coatings, inks, and solvent industries. Originating from C9 aromatic hydrocarbons, Solvesso 100 is closely tied to crude oil and feedstock dynamics—making its pricing both critical and sensitive.

Here’s a refined look at the driving factors behind Solvesso 100 price trends, blending market intelligence with clear, down-to-earth insight.

1. Crude Oil & Feedstock Volatility

Solvesso 100 is a byproduct of petroleum refining. As such, the cost of solvesso hinges on crude oil, naphtha, and related feedstock prices—components that make up approximately 60–75% of production cost.

A bump in crude oil can increase aromatic solvent prices significantly; a $10 per barrel rise may add $120–$150 per ton to production costs. P Market ResearchResearch and Markets

Feedstock cost structures are even more volatile in import-dependent regions, where currency fluctuations can amplify local price swings. Research and Markets

2. Regional Supply & Logistics Constraints

Solvent pricing diverges across geographies—thanks to variable logistics and refinery operations.

In Q4 2024, the Middle East & Africa saw price dips to around $980/MT CIF Jebel Ali, due to ample supply and slowing demand. ChemAnalyst

In contrast, Asia-Pacific markets, like India, experienced price increases—up to $1,050/MT—driven by tightening inventory levels and shipping delays. CrivvaGoogle Sites

3. Seasonal & Regional Demand Cycles

Economies like India and Southeast Asia see price shifts tied to seasonal demand—especially construction, coatings, and adhesives.

Q2 2024 brought down prices in India (near $980/MT) due to seasonal monsoon slowdowns. Crivva

Conversely, Q1–Q2 2025 saw prices rebound as inventories tightened and buyers restocked—Euro markets rose to around $1,020/MT, Asia held near $1,050/MT. CrivvaGoogle Sites

4. Regulatory & Environmental Pressures

Global moves toward low-VOC formulations and tighter environmental standards are reshaping solvent demand. While Solvesso 100 remains entrenched in coatings, regulatory shifts toward greener alternatives could disrupt pricing in the future. P Market ResearchGII Research

5. Strategic Market Outlook for 2025

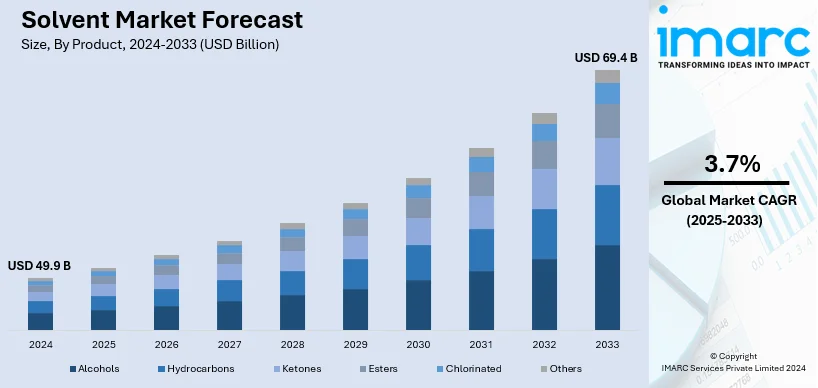

Analysts predict that the C9 solvent market (including Solvesso 100) will grow at a 3.9% CAGR through 2030, bolstered by steady demand in construction, automotive, and adhesives. CrivvaGII Research

Many suppliers are adapting contracting strategies—like tying prices to monthly feedstock averages—to manage volatility more effectively. P Market Research

Price Comparison Table: 2025 Regional Snapshot

| Region | Recent Price (USD/MT) | Primary Trend Drivers |

|---|---|---|

| Middle East / Africa | ~980 | Strong supply, muted demand |

| Asia-Pacific | ~1,050 | Inventory tightness, shipping delays |

| Europe | ~1,020 | Restocking, stable crude oil margins |

| Global Crude Impact | N/A | Direct cost swings tied to oil volatility |

Crude Oil Driven – Feedstock costs remain the dominant pricing factor.

Seasonal Fluctuations – Monsoons and restocking cycles drive notable price moves.

Regional Variance – MEA supply surplus vs APAC tightness create price discrepancies

Regulatory Overhang – Future pricing influenced by low-VOC and compliance demands.

Looking for solvesso suppliers in Iran ?

- Contact Us today and get connected with producers and export-ready logistics.

- sales@PetroExportHub.com

Related posts

Mono Ethylene Glycol (MEG) serves as a cornerstone for modern antifreeze and coolant formulations, offering reliable freezing protection and heat resi . . .

Explore Solvent 100’s specs, uses, and export opportunities from Iran. Ideal for paint, ink, and adhesive buyers in India, Turkey, UAE, and Africa. . . .

Explore everything you need to know about exporting sulphur from Iran in 2024 — including types, packaging, documents, ports, prices, and top import . . .

Explore Iran’s top ports for petrochemical exports, including Bandar Imam Khomeini, Assaluyeh, and Bandar Abbas. Compare infrastructure, accessibili . . .

Learn the key differences between polypropylene (PP) and polyethylene (PE), their applications, advantages, and how to choose the right polymer for yo . . .

Discover how a Turkish plastics manufacturer reduced costs by 22% through importing HDPE from Iran. Real-world case study by PetroExportHub. . . .

Learn why Iran is a leading exporter of polyethylene (PE). Discover grades, global applications, and how PetroExportHub connects buyers with top suppl . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality