Description

Phthalic Anhydride (PA): Essential Intermediate for Industrial Chemicals and Resins

Introduction

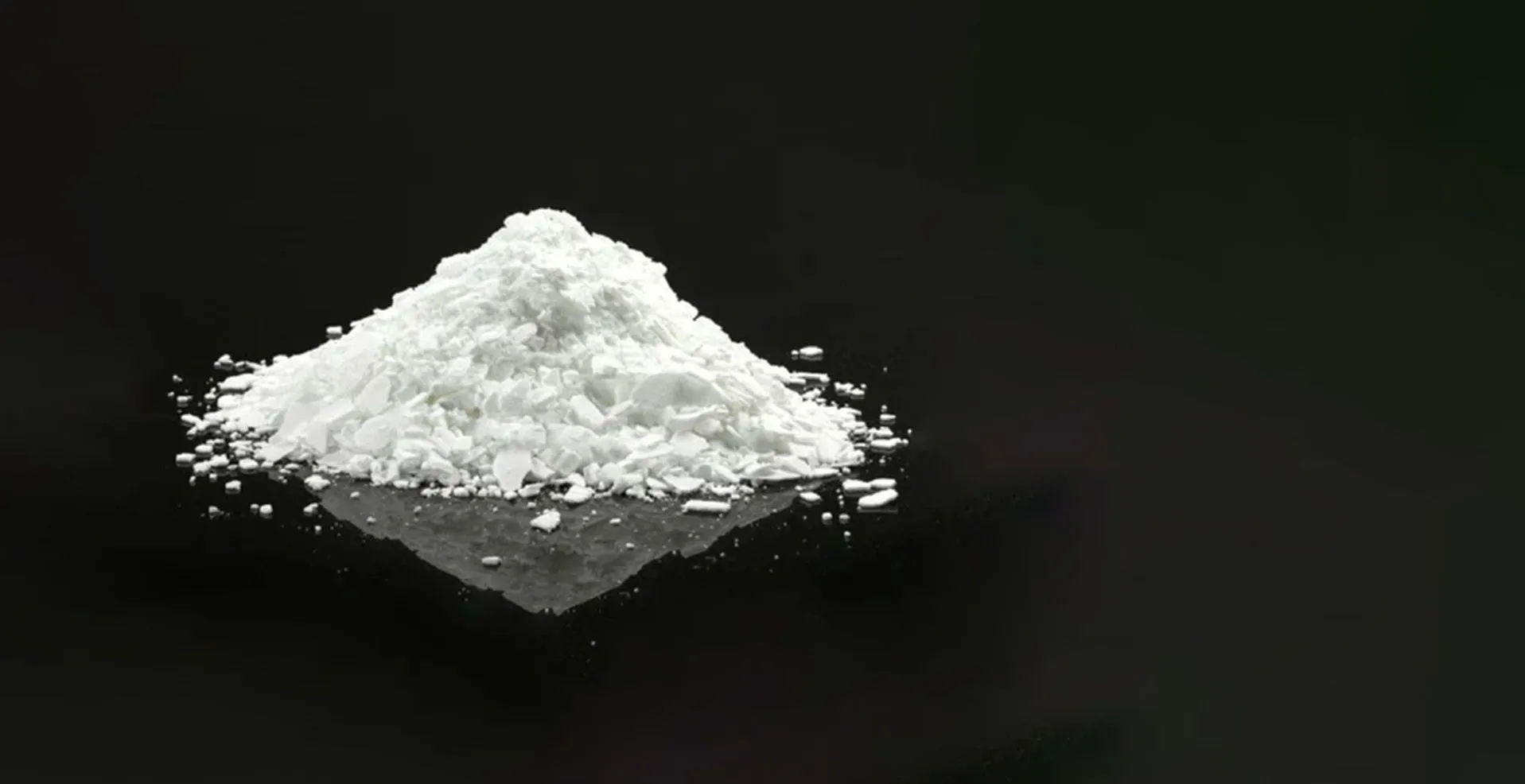

Phthalic Anhydride (PA), a cyclic anhydride derived from phthalic acid, is a pivotal organic compound in the petrochemical sector, known for its role as a versatile building block in synthetic chemistry. With the formula C6H4(CO)2O, this white crystalline solid is produced primarily through the oxidation of orthoxylene or naphthalene, serving as a key precursor for high-performance materials. Its industrial significance cannot be overstated, as it drives the production of plasticizers, resins, and coatings that underpin global manufacturing in automotive, construction, and consumer goods. For international B2B buyers, sourcing from a reliable phthalic anhydride supplier ensures access to high-purity PA chemical export, meeting the demands of a market projected to reach 5.08 million tons by 2030. Amid rising sustainability focus, PA’s efficiency in creating durable, recyclable products positions it as indispensable for forward-thinking industries.

Technical Specifications

Understanding the technical specifications of Phthalic Anhydride is crucial for B2B procurement decisions. PA typically appears as white crystalline flakes or molten liquid, with a purity level exceeding 99.5% in industrial grades to minimize impurities like benzoic acid or maleic anhydride. Its molecular weight stands at 148.12 g/mol, ensuring consistent reactivity in downstream processes.

Key physical properties include a melting point of 131–132°C and a boiling point of 295°C at atmospheric pressure, with a density of 1.53 g/cm³ in solid form. Chemically, PA exhibits low solubility in water (about 0.6 g/100mL at 20°C) but dissolves readily in organic solvents such as alcohols, ethers, and acetone, facilitating its use in resin formulations. It has a flash point of 152°C and an auto-ignition temperature around 570°C, requiring careful handling to prevent exothermic reactions with water or bases.

Performance attributes encompass high thermal stability and reactivity with alcohols to form esters, making it ideal as a plasticizer raw material. Reputable phthalic anhydride suppliers maintain strict controls on moisture content (below 0.05%) and color index (APHA <20) to guarantee product integrity during PA chemical export.

Applications

Phthalic Anhydride’s applications span critical industries, underscoring its value as an unsaturated polyester resin feedstock and beyond. In the plastics sector, PA is fundamental for producing dioctyl phthalate (DOP) and other plasticizers, which enhance PVC flexibility for cables, flooring, and automotive interiors—accounting for over 50% of global PA consumption.

In coatings and paints, PA contributes to alkyd resins, providing weather-resistant finishes for architectural and industrial uses. The composites industry relies on PA for unsaturated polyester resins (UPR), essential in fiberglass-reinforced plastics for boats, pipes, and wind turbine blades, where its cross-linking properties ensure structural strength.

Additionally, PA serves in dyes and pigments, offering vibrant colors for textiles and inks, while in agrochemicals, it acts as an intermediate for herbicides and insecticides. Emerging uses include flame retardants and pharmaceutical precursors, expanding its footprint in high-tech sectors. B2B buyers seeking a phthalic anhydride supplier often prioritize PA for its multifaceted role in boosting product performance across these applications.

Export & Supply Insights

Global demand for Phthalic Anhydride remains robust, particularly in Asia-Pacific, which commands over 50% of the market due to booming construction and automotive sectors in China and India. The Middle East benefits from integrated petrochemical hubs, driving exports to meet regional infrastructure needs. In Africa, growing industrialization fuels PA imports for resins and coatings, while Europe focuses on sustainable applications amid regulatory shifts.

Buyers in these regions seek reliable phthalic anhydride suppliers for consistent supply chains, with the global market valued at USD 1.58 billion in 2024 and expected to grow at 7.84% CAGR through 2025. PA chemical export from producers in Asia and the Middle East addresses this demand, supported by strategic logistics and production capacities exceeding 4.5 million tons in 2025.

Price Trends

Phthalic anhydride price trends are influenced by feedstock costs, such as orthoxylene and naphthalene, alongside supply-demand dynamics and energy prices. In 2025, phthalic anhydride prices have shown regional variations: North America at approximately USD 1.31/kg, Europe at USD 1.43/kg, and Northeast Asia at USD 0.92/kg as of August, reflecting a slight decline from Q1 peaks due to ample supply and moderated demand. Q2 saw a 1.6% drop in Europe to USD 1195/MT, driven by high inventories.

B2B buyers monitor phthalic anhydride price fluctuations closely, as rises in feedstock costs—up 1.2% in Asia Q1 2025—can impact margins in plasticizer production. Overall, phthalic anhydride prices are projected to stabilize amid growing demand, offering opportunities for strategic sourcing.

Compliance & Safety

Compliance with international standards is paramount for Phthalic Anhydride handling and trade. PA meets REACH regulations in Europe for safe chemical use, alongside ISO 9001 for quality management in production. Safety guidelines classify it as a skin and respiratory irritant (UN Hazard Class 8), recommending protective equipment and ventilation to avoid hydrolysis into phthalic acid.

Packaging adheres to standards like 25kg bags or 500kg supersacks, ensuring moisture-proof transport during PA chemical export. Phthalic anhydride suppliers emphasize SDS compliance and eco-friendly practices, reducing environmental impact through efficient processes.

Competitive Advantage

Sourcing Phthalic Anhydride from Middle Eastern exporters provides distinct advantages, including cost efficiencies from advantaged naphtha feedstocks and integrated facilities in Saudi Arabia and the UAE. These regions offer 20-30% lower production costs compared to Europe, enhancing phthalic anhydride price competitiveness for global buyers.

Logistics benefits from strategic ports facilitate swift PA chemical export to Asia, Africa, and Europe, minimizing lead times. Unlike alternatives, Middle Eastern phthalic anhydride suppliers leverage R&D for high-purity grades, supporting sustainable applications and long-term partnerships.

| Aspect | Phthalic Anhydride (PA) | Maleic Anhydride (MA) |

|---|---|---|

| Primary Use | Plasticizers, UPR, Alkyd Resins | Unsaturated Polyesters, Additives |

| Feedstock | Orthoxylene/Naphthalene | Butane/Benzene |

| Global Price (2025 Avg.) | USD 1.00-1.40/kg | USD 1.20-1.60/kg |

| Market Demand Growth | 4.25% CAGR to 2030 | 3.5% CAGR |

| Advantages | Versatile, Cost-Effective | Higher Reactivity in Copolymers |

Summary & Features

Phthalic Anhydride stands as a cornerstone for chemical manufacturing, enabling durable materials in plastics and coatings worldwide. Reliable phthalic anhydride suppliers ensure high-quality supply amid growing global demand exceeding 4.5 million tons in 2025. Fluctuating phthalic anhydride prices highlight the need for strategic sourcing from cost-advantaged regions like the Middle East. Its compliance with REACH and ISO standards supports safe, sustainable industrial applications. Ultimately, PA’s versatility drives innovation in B2B sectors, from automotive to agrochemicals.

- High Purity Levels: Exceeding 99.5%, ensuring optimal performance as a plasticizer raw material and unsaturated polyester resin feedstock.

- Versatile Industrial Applications: Critical in DOP production, alkyd resins, and dyes, catering to diverse global needs.

- Competitive Phthalic Anhydride Price: Influenced by efficient Middle Eastern production, offering cost savings for international buyers.

- Strong Global Demand: Fueled by Asia-Pacific growth, making it a strategic choice for phthalic anhydride suppliers focused on export.

Reviews

There are no reviews yet.