How U.S. Ethane Export Restrictions Impact China’s Petrochemical Sector

1. What Happened? U.S. Restrictions & Their Lift

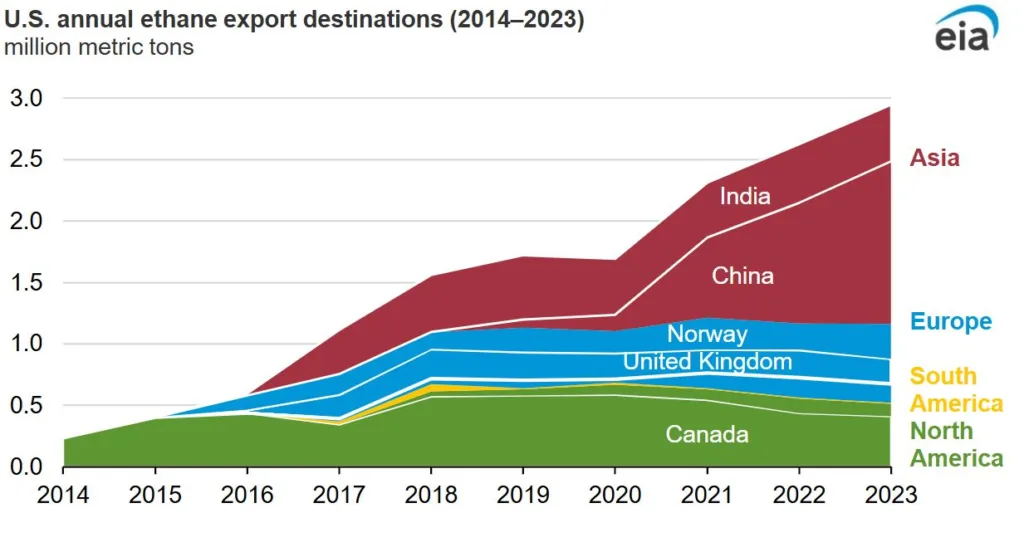

In late May to early June 2025, the U.S. imposed special licensing requirements on ethane exports to China, citing national security risks, including China’s military end-user ties

- The restrictions disrupted flows and delayed shipments, with some Very Large Ethane Carriers (VLECs) stranded off the Gulf Coast, and cargo volumes dropping significantly—from around 541,000 barrels/day in April to ~420,000 barrels/day in June.

- By early July, restrictions were eased: exporters were once again allowed to load ethane bound for China—but unloading in China still required additional licensing.

2. Impacts on U.S. Ethane Exporters

Financial Hit: Energy Transfer reported an 11.5% drop in net income, while revenues came in below expectations.

- Reputational Damage: Both Energy Transfer and Enterprise Products Partners cited damage to the U.S. industry’s reliability and credibility—with Energy Transfer’s co-CEO calling it a “black eye” for the sector.

- Market Oversupply & Price Decline: With limited alternative export routes and infrastructure, U.S. domestic ethane supply ballooned, causing ethane prices to fall from about $0.25 to under $0.22 per gallon and creating a contango market.

3. Effect on China’s Petrochemical Industry

Limited Vulnerability: U.S. ethane accounts for just 7–10% of China’s ethylene feedstock. China primarily relies on naphtha (≈69%), coal-to-olefins (≈16%), and is less dependent on ethane.

- Built-in Flexibility: Modern Chinese cracker facilities can readily switch to alternative feedstocks (naphtha, propane, butane) with minimal disruption. Analysts estimate that even a complete cessation of U.S. ethane would only reduce China’s ethylene output by around 5–6%

4. Wider Lessons & Strategic Implications

Policy Backfire: Observers at CSIS argue that these restrictions were ill-conceived—hurting U.S. interests without meaningful strategic gain —and could signal unreliability to trading partners

- Shifted Trade Patterns: Energy export controls on ethane are part of a broader shift in trade negotiations, with U.S. policymakers now including items like jet engines and chip software in export control discussions.

| Impact Area | U.S. Exporters | Chinese Petrochemicals |

|---|---|---|

| Supply Flow | Disruptions and delays | Minimal systemic disruptions |

| Financial Effects | Profit and price drops | Higher feedstock cost, but manageable |

| Long-Term Risk | Reputational damage, contractual fragility | Greater focus on feedstock diversification |

Category: Market Updates

News Related

PVC prices in South Asia are facing fluctuations in July 2025 due to weak construction demand, freight costs, and shifting imports from China and Iran . . .

Sulphur exports from Iran to the UAE increased sharply in July 2025 amid rising demand from fertilizer and refining industries. Discover key trends an . . .

Urea prices in Turkey dropped in July 2025 due to lower demand and increased supply from regional producers. Learn how this impacts importers and expo . . .

Iranian bitumen exports to Africa are increasing in July 2025, as regional infrastructure projects expand. Learn what this means for exporters and imp . . .

Petrochemical prices in Turkey show significant changes in July 2025 due to regional supply dynamics and currency fluctuations. See how this impacts i . . .

Sulphur exports from Iran to India increased in July 2025 due to rising demand in the fertilizer and chemical industries. Learn what this means for tr . . .

Sulphur exports from Iran to India increased in July 2025 due to rising demand in the fertilizer and chemical industries. Learn what this means for tr . . .

Tehran, Iran – PetroExportHub has announced the launch of its first granular sulphur shipments to East African ports, following a new logistics part . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality