Petrochemical Exports and the Shift to Circular Economy: Opportunities in Recycling

Introduction

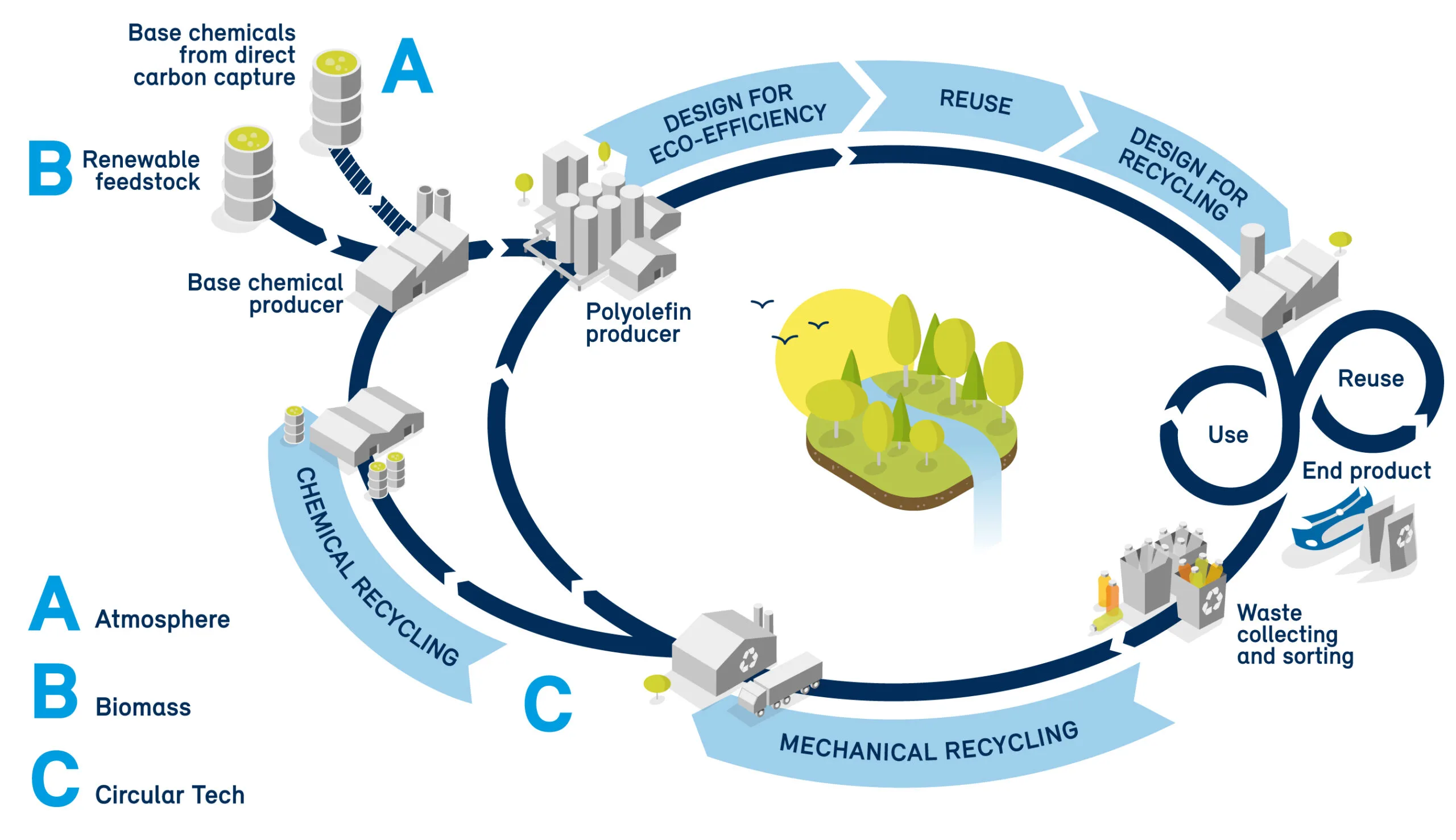

The petrochemical industry is at a turning point. With rising global demand for plastics and chemicals, exporters face increasing pressure from regulators, customers, and environmental groups to adopt sustainable practices. One of the most significant transformations shaping the future of petrochemical exports is the shift toward a circular economy.

Unlike the traditional “take–make–dispose” linear model, the circular economy emphasizes reuse, recycling, and reducing waste, creating new opportunities for exporters of raw materials and finished petrochemical products. This shift is especially important for markets in Europe, Asia, and North America, where demand for recycled and low-carbon feedstocks is rapidly expanding.

Why the Circular Economy Matters for Petrochemical Exports

The petrochemical sector, particularly polyethylene (PE), polypropylene (PP), and PET, is under scrutiny for contributing to plastic waste and carbon emissions. Governments are setting stricter policies, while global brands demand sustainable raw materials for their supply chains.

For exporters, this means:

Market access depends on sustainability. Buyers increasingly prefer recycled or bio-based alternatives.

Higher margins for sustainable products. Green-certified polymers often sell at premium prices.

Risk reduction. Circular economy adoption reduces exposure to future carbon taxes and bans.

Table 1: Global Policy Drivers for Circular Economy in Petrochemicals

| Region | Key Policy/Initiative | Impact on Exports |

|---|---|---|

| European Union | EU Green Deal, Plastic Packaging Directive | Strong demand for recycled polymers |

| United States | Extended Producer Responsibility (EPR) laws | Push for local recycling, but imports of recycled feedstocks grow |

| Asia (China, India) | Plastic waste bans, recycling targets | Expanding demand for secondary polymers |

| Middle East | National sustainability visions (e.g., KSA Vision 2030, UAE Net Zero) | Exporters must integrate recycling capacity |

Opportunities for Exporters in Recycling

Export of Recycled Feedstocks

Recycled polyethylene (rPE) and recycled polypropylene (rPP) are in high demand in Europe and Asia.

Technology Partnerships

Exporters can invest in advanced chemical recycling technologies (pyrolysis, depolymerization) to create higher-value recycled outputs.

Brand Collaboration

Partnering with global FMCG and packaging companies that need recycled content for compliance.

Premium Market Positioning

Offering ISCC-certified recycled materials enhances credibility and allows penetration into high-value markets.

Table 2: Petrochemical Export Models in a Circular Economy

| Model Type | Description | Export Opportunity | Example Products |

|---|---|---|---|

| Mechanical Recycling | Physical processing of waste plastics | Strong in Asia & EU | rPE, rPP, rPET |

| Chemical Recycling | Breaking down plastics to monomers | Emerging, high-value | r-Naphtha, r-MEG |

| Bio-based Feedstocks | Derived from renewable raw materials | Niche, premium markets | Bio-PE, Bio-PET |

Challenges Facing Exporters

Infrastructure Gaps: Limited large-scale recycling facilities in some regions.

Cost Competitiveness: Virgin petrochemicals often remain cheaper than recycled ones.

Standardization Issues: Lack of harmonized certifications across export markets.

Technology Barriers: Chemical recycling is still expensive and not widely available.

Future Outlook

By 2030, recycled and bio-based feedstocks are expected to account for 15–20% of global polymer demand. Exporters who invest early in recycling capabilities and sustainability certifications will not only meet compliance requirements but also gain a first-mover advantage in premium markets.

Circular economy policies are creating new export opportunities in recycled feedstocks.

Europe and Asia are the fastest-growing markets for recycled and bio-based polymers.

Exporters can benefit from premium pricing if they achieve sustainability certifications.

Challenges include infrastructure, costs, and standardization, but first movers gain an advantage.

Looking for supplier?

- Contact Us today and get connected with producers and export-ready logistics.

- sales@PetroExportHub.com

Related posts

Mono Ethylene Glycol (MEG) serves as a cornerstone for modern antifreeze and coolant formulations, offering reliable freezing protection and heat resi . . .

Explore Solvent 100’s specs, uses, and export opportunities from Iran. Ideal for paint, ink, and adhesive buyers in India, Turkey, UAE, and Africa. . . .

Explore everything you need to know about exporting sulphur from Iran in 2024 — including types, packaging, documents, ports, prices, and top import . . .

Explore Iran’s top ports for petrochemical exports, including Bandar Imam Khomeini, Assaluyeh, and Bandar Abbas. Compare infrastructure, accessibili . . .

Learn the key differences between polypropylene (PP) and polyethylene (PE), their applications, advantages, and how to choose the right polymer for yo . . .

Discover how a Turkish plastics manufacturer reduced costs by 22% through importing HDPE from Iran. Real-world case study by PetroExportHub. . . .

Learn why Iran is a leading exporter of polyethylene (PE). Discover grades, global applications, and how PetroExportHub connects buyers with top suppl . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality