Digital Transformation in Petrochemical Trade: AI, Data & E-commerce

Introduction

The petrochemical industry has always been global, capital-intensive, and data-heavy. But until recently, trade practices remained highly traditional — dependent on brokers, phone calls, emails, and physical documentation. With rapid technological innovation, the sector is now undergoing a digital revolution. The rise of AI in petrochemical trade, integrated data analytics, blockchain, and online marketplaces is reshaping how buyers and exporters connect, negotiate, and manage supply chains. The companies that embrace this shift are securing competitive advantages in speed, cost, transparency, and risk management.

Why Digital Transformation Matters in Petrochemicals

Speed & Efficiency – Digital platforms cut transaction times from days to hours.

Transparency – Buyers can compare offers, track shipments, and verify quality instantly.

Market Access – Petrochemical e-commerce platforms allow smaller exporters to reach global buyers without relying solely on traditional traders.

Risk Reduction – Digital trade tools minimize fraud, errors, and supply chain disruptions.

Cost Optimization – AI-driven pricing models and route optimization reduce operational expenses.

Role of AI in Petrochemical Trade

Artificial intelligence is one of the strongest forces accelerating change:

Price Forecasting: Algorithms analyze crude oil trends, freight costs, and historical patterns to predict the next shift in PE100B, MEG, or SN150 prices.

Demand Forecasting: AI anticipates regional consumption spikes (e.g., textile MEG demand in Asia).

Smart Contracts: Integrated with blockchain, AI ensures trade agreements trigger automatically when conditions are met.

Fraud Detection: Spotting anomalies in invoices, bills of lading, or banking records.

Repeat: The adoption of AI in petrochemical trade enables exporters and buyers to make faster, data-backed, and less risky decisions.

Data-Driven Petrochemical Supply Chains

Digital trade is not only about transactions — it’s also about supply chain intelligence. A data-driven petrochemical supply chain improves performance by:

Real-Time Visibility: IoT sensors on containers monitor temperature, pressure, and movement.

Inventory Optimization: Analytics balance stock between hubs in UAE, Turkey, and Asia.

Predictive Logistics: Algorithms adjust routes to avoid port congestion or geopolitical risks.

Carbon Tracking: Data systems calculate the environmental impact, essential for sustainability reporting.

In short, a data-driven petrochemical supply chain helps exporters reduce costs, meet compliance, and increase customer trust.

Petrochemical E-commerce Platforms: Changing Trade Dynamics

The emergence of petrochemical e-commerce platforms mirrors what happened in metals, agriculture, and consumer goods. These platforms allow:

Digital Marketplaces: Buyers browse listings for MEG, PE100B, solvents, and sulphur from multiple suppliers.

Instant Price Discovery: Transparent, real-time pricing reduces reliance on brokers.

Secure Payment Gateways: Integration with trade finance tools (letters of credit, escrow) ensures smooth payments.

Global Buyer Access: A supplier in Iran can reach a buyer in Africa or South Asia in minutes.

Such petrochemical e-commerce platforms are already reshaping how exporters connect with new markets.

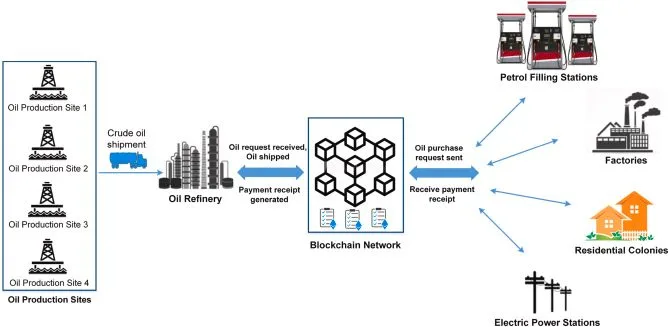

Blockchain & Smart Contracts in Petrochemical Trade

Beyond AI and e-commerce, blockchain adds another digital layer of trust:

Tamper-Proof Documentation: Bills of lading, certificates of origin, and invoices stored on blockchain reduce fraud.

Smart Contracts: Automatic execution of payment when shipment milestones are verified.

Traceability: From refinery to buyer, the product journey is transparent and immutable.

This creates confidence for both buyers and sellers in regions where counterparty risk is high.

Benefits for Exporters & Buyers

For Exporters:

Reach more buyers at lower cost.

Offer faster quotes and reduce negotiation friction.

Build brand visibility as a tech-forward supplier.

For Buyers:

Transparent price benchmarking across suppliers.

Easier compliance documentation (especially for EU/Asia imports).

Reduced risk of fraud and delivery delays.

Challenges & Barriers to Digital Adoption

Trust Gap: Some buyers still prefer traditional intermediaries.

Integration Costs: Small exporters may lack resources to implement advanced tools.

Cybersecurity Risks: Trade data is sensitive and needs protection.

Regulatory Hurdles: Not all customs authorities accept blockchain or e-documents.

Despite challenges, adoption is accelerating, especially in Asia and the Middle East.

The Future: Fully Digital Petrochemical Trade

The next 5–10 years may see:

AI predicting market demand with 90%+ accuracy.

Entire shipments tracked with IoT + blockchain, visible to all parties.

Virtual trading rooms replacing physical trade shows.

Integration of sustainability reporting into digital platforms.

The companies that invest now in AI in petrochemical trade, data-driven petrochemical supply chains, and petrochemical e-commerce platforms will lead the future of global trade.

FAQ

Q1: Are petrochemical e-commerce platforms reliable?

Yes. Most major platforms now integrate escrow payments, KYC verification, and blockchain-backed documents.

Q2: How does AI improve trade efficiency?

It automates forecasting, pricing, and logistics planning, reducing human error and decision delays.

Q3: Can small exporters benefit?

Absolutely. Digital platforms reduce reliance on costly intermediaries and expand global reach.

Q4: What about cybersecurity risks?

Using encrypted systems, multi-factor authentication, and blockchain significantly reduces vulnerabilities.

Data-driven petrochemical supply chain reduces costs and boosts resilience.

Petrochemical e-commerce platforms expand global buyer reach instantly.

Blockchain & smart contracts increase transparency and security in exports.

AI-driven forecasting improves price, demand, and logistics decisions.

Would you be looking for suppliers in Iran?

- Contact Us today and get connected with producers and export-ready logistics.

- sales@PetroExportHub.com

Related posts

Mono Ethylene Glycol (MEG) serves as a cornerstone for modern antifreeze and coolant formulations, offering reliable freezing protection and heat resi . . .

Explore Solvent 100’s specs, uses, and export opportunities from Iran. Ideal for paint, ink, and adhesive buyers in India, Turkey, UAE, and Africa. . . .

Explore everything you need to know about exporting sulphur from Iran in 2024 — including types, packaging, documents, ports, prices, and top import . . .

Explore Iran’s top ports for petrochemical exports, including Bandar Imam Khomeini, Assaluyeh, and Bandar Abbas. Compare infrastructure, accessibili . . .

Learn the key differences between polypropylene (PP) and polyethylene (PE), their applications, advantages, and how to choose the right polymer for yo . . .

Discover how a Turkish plastics manufacturer reduced costs by 22% through importing HDPE from Iran. Real-world case study by PetroExportHub. . . .

Learn why Iran is a leading exporter of polyethylene (PE). Discover grades, global applications, and how PetroExportHub connects buyers with top suppl . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality