CBAM and Its Impact on Petrochemical Exports to Europe

Introduction

The Carbon Border Adjustment Mechanism (CBAM), introduced by the European Union (EU), is reshaping global trade dynamics. While initially targeted at carbon-intensive industries like steel, cement, and fertilizers, the implications for the petrochemical export sector are significant. For exporters in regions such as the Middle East and Asia, CBAM is more than just a compliance requirement—it’s a factor that directly impacts pricing, competitiveness, and market access in Europe.

This article explores how CBAM works, why it matters for petrochemical exporters, and strategies to adapt for long-term success.

What is CBAM?

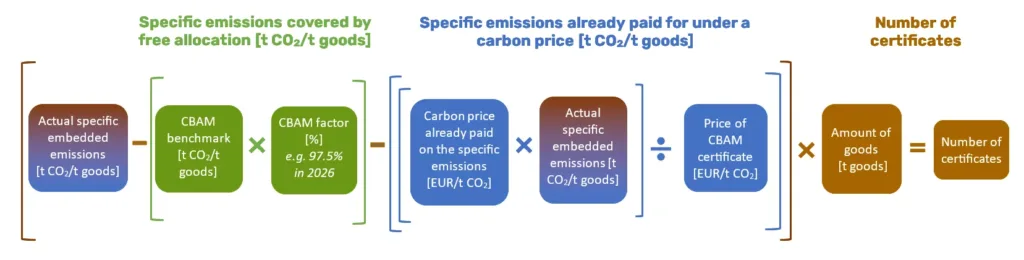

CBAM is essentially a carbon tax at the border. Importers of carbon-intensive products into the EU must purchase certificates reflecting the carbon emissions embedded in those products. The mechanism aims to:

Prevent carbon leakage (moving industries outside the EU to avoid carbon costs).

Ensure fair competition for EU manufacturers.

Encourage exporters worldwide to reduce their carbon footprint.

Why Petrochemical Exports Are Affected

Petrochemicals, by nature, are energy-intensive products. From ethylene and propylene production to derivatives like PE, PP, and MEG, the carbon footprint is high due to:

Heavy reliance on natural gas and crude oil feedstocks.

Energy-intensive cracking processes.

Limited use of renewable energy in production.

As a result, exporters from Iran, the Middle East, and Asia are likely to face higher costs when targeting the EU market.

Table 1: Potential Petrochemical Products Under CBAM Risk

| Petrochemical Product | Carbon Intensity Level | EU Import Dependency | CBAM Impact Level |

|---|---|---|---|

| Polyethylene (PE) | High | Strong | High |

| Polypropylene (PP) | Medium | Moderate | Medium |

| Monoethylene Glycol | High | Strong | High |

| Methanol | High | Moderate | High |

| PVC | Medium | Moderate | Medium |

Challenges for Exporters

Increased Export Costs

CBAM certificates add an extra layer of expense to exporters.

Competitiveness Pressure

EU buyers may shift to local or lower-carbon suppliers.

Compliance Complexity

Exporters must calculate and verify the carbon intensity of each shipment.

Risk of Market Diversion

If Europe becomes too expensive, exporters may need to redirect volumes to Asia or Africa.

Strategies to Overcome CBAM Risks

Carbon Footprint Transparency

Invest in carbon accounting tools to measure emissions across the supply chain.

Energy Efficiency Investments

Upgrade plants with cleaner technologies and adopt renewable energy sources.

Partnerships with EU Buyers

Collaborate with European companies that prioritize low-carbon imports.

Diversification of Markets

Expand exports to Asia, CIS, and Africa, where CBAM does not apply.

Table 2: Comparison of CBAM vs Non-CBAM Markets for Petrochemicals

| Market Region | Carbon Tax Applied | Import Demand Growth | Export Opportunity |

|---|---|---|---|

| European Union | Yes (CBAM enforced) | Moderate (2–3%) | Challenging, cost-sensitive |

| Asia (China, India) | No | High (5–7%) | Strong, growing demand |

| CIS & Turkey | No | Moderate (3–4%) | Steady, competitive |

| Africa | No | High (6–8%) | Emerging market potential |

Future Outlook

As CBAM fully rolls out by 2026, petrochemical exporters must adapt or risk losing access to one of the most lucrative markets in the world. The future belongs to exporters who embrace decarbonization, develop low-carbon petrochemical products, and diversify beyond Europe.

Would you be looking for suppliers in Iran?

- Contact Us today and get connected with producers and export-ready logistics.

- sales@PetroExportHub.com

Related posts

Mono Ethylene Glycol (MEG) serves as a cornerstone for modern antifreeze and coolant formulations, offering reliable freezing protection and heat resi . . .

Explore Solvent 100’s specs, uses, and export opportunities from Iran. Ideal for paint, ink, and adhesive buyers in India, Turkey, UAE, and Africa. . . .

Explore everything you need to know about exporting sulphur from Iran in 2024 — including types, packaging, documents, ports, prices, and top import . . .

Explore Iran’s top ports for petrochemical exports, including Bandar Imam Khomeini, Assaluyeh, and Bandar Abbas. Compare infrastructure, accessibili . . .

Learn the key differences between polypropylene (PP) and polyethylene (PE), their applications, advantages, and how to choose the right polymer for yo . . .

Discover how a Turkish plastics manufacturer reduced costs by 22% through importing HDPE from Iran. Real-world case study by PetroExportHub. . . .

Learn why Iran is a leading exporter of polyethylene (PE). Discover grades, global applications, and how PetroExportHub connects buyers with top suppl . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality