Archive Articles

- Ask an Expert

- Export Guides

- Market Trends

- Product Comparison

- Shipping & Packaging

- Trade Compliance

- Uncategorized

Petrochemical exporters face hidden costs that reduce profitability, including insurance premiums, demurrage charges, and port delays. These costs can add up to 12% of shipment value. Insurance is unavoidable but manageable . . .

PE100B and LLDPE are two key polymers with different strengths. PE100B is stronger, pressure-resistant, and ideal for pipeline projects, while LLDPE is flexible and cost-effective but more suited to packaging and films. The . . .

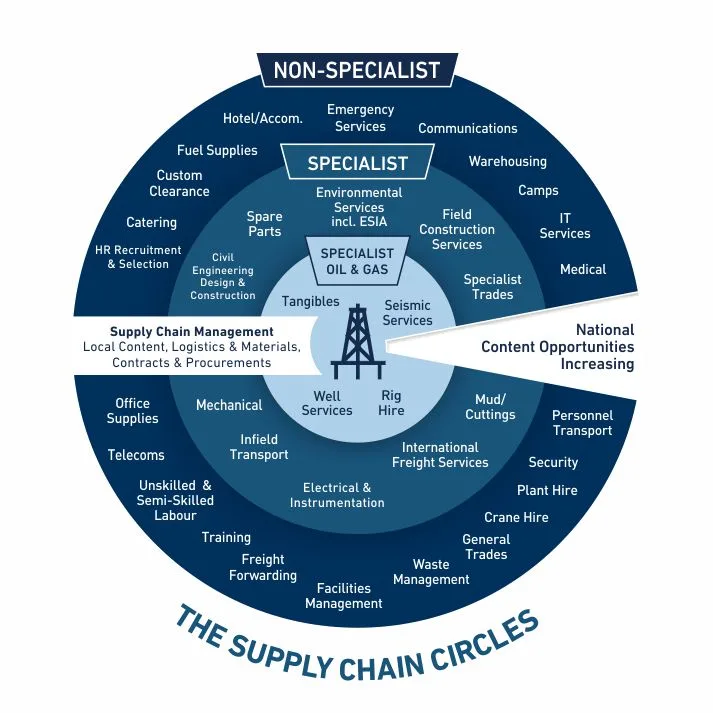

Digital transformation is reshaping petrochemical trade through AI, data, and e-commerce. AI in petrochemical trade enables accurate forecasts and smarter contracts. A data-driven petrochemical supply chain gives real-time v . . .

Sustainability in petrochemical supply chains requires action across feedstock, energy, logistics, packaging, and governance. Measuring and reporting the carbon footprint of petrochemicals (scopes 1–3) is the foundation fo . . .

Customs clearance is one of the most critical steps in petrochemical exports, where mistakes can cause major delays and financial losses. Exporters of PE100B, SN150, solvents, and MEG must carefully manage HS codes, document . . .

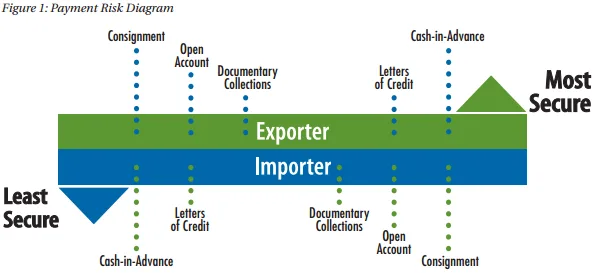

International payment methods are crucial for the chemical trade industry, where risks are high and margins depend on reliability. Exporters of PE100B, SN150, and MEG must balance security with flexibility in choosing betwee . . .

Geopolitical risks such as wars, sanctions, and shipping disruptions are reshaping global chemical export markets. They directly influence prices, logistics, and buyer confidence. Products like PE100B, SN150, and MEG are par . . .

Free Trade Zones (FTZs) are becoming vital for petrochemical exporters, offering reduced costs, faster logistics, and broader market access. They provide exporters of PE100B, SN150, and MEG with competitive advantages in pri . . .