Archive Articles

- Ask an Expert

- Export Guides

- Market Trends

- Product Comparison

- Shipping & Packaging

- Trade Compliance

- Uncategorized

Mono Ethylene Glycol (MEG) buyers are facing increasing uncertainty in spot markets, while long-term contract prices remain relatively stable. This widening gap is driven by logistics disruptions, feedstock price swings, reg . . .

Africa is rapidly emerging as one of the most promising growth markets for the global petrochemical industry. Population growth, urbanization, industrial expansion, and infrastructure development are driving unprecedented de . . .

Large petrochemical buyers rarely leave purchasing decisions to chance. In volatile markets, strategic stockpiling has become a core risk-management tool used by manufacturers, refiners, and trading houses worldwide. By care . . .

Global petrochemical markets continue to face repeated shortages despite capacity expansions in the Middle East and Asia. Scarcity in products such as MEG, PVC, Polypropylene, Acrylonitrile, and aromatics comes from mismatch . . .

Petrochemical price indexes such as ICIS and Platts are the backbone of global pricing, influencing everything from contract negotiations to shipping routes. These benchmarks reflect real-time shifts in supply, demand, feeds . . .

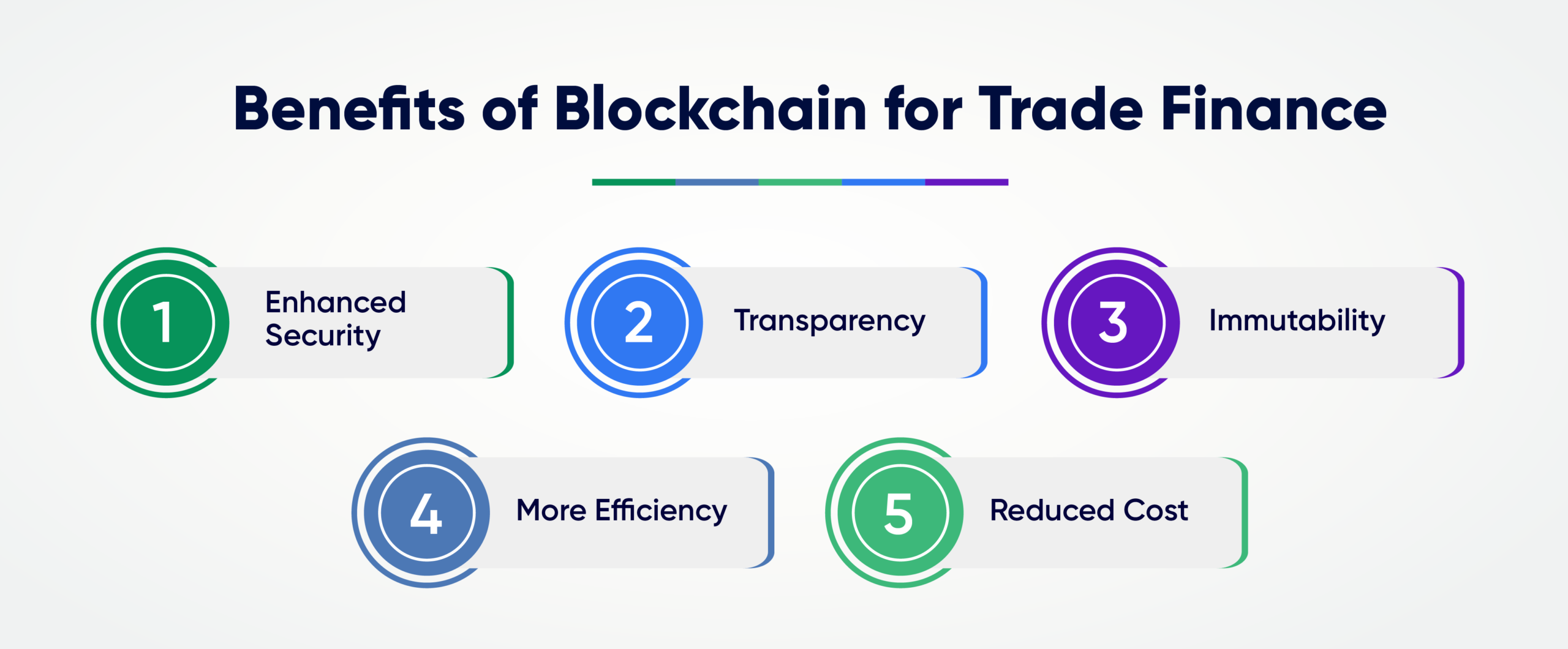

Blockchain is transforming petrochemical exports by securing contracts and ensuring compliance. Smart contracts automate payments, reducing risk of delays and defaults. Exporters benefit from faster customs clearance and tra . . .

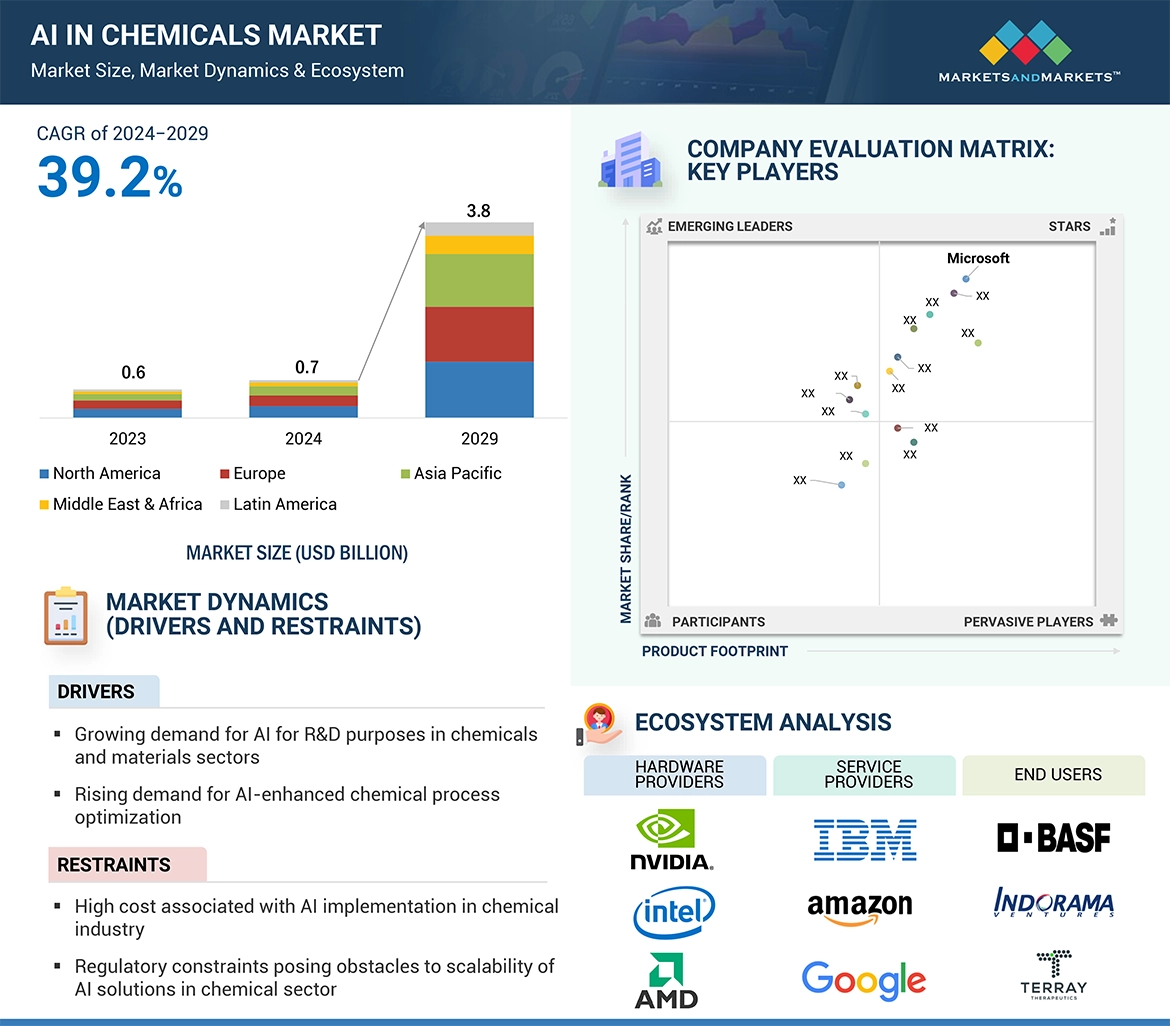

AI is transforming petrochemical market forecasting by predicting demand, pricing, and trade flows. Exporters benefit from smarter pricing, reduced risks, and stronger negotiation power. Real-time data integration ensures hi . . .

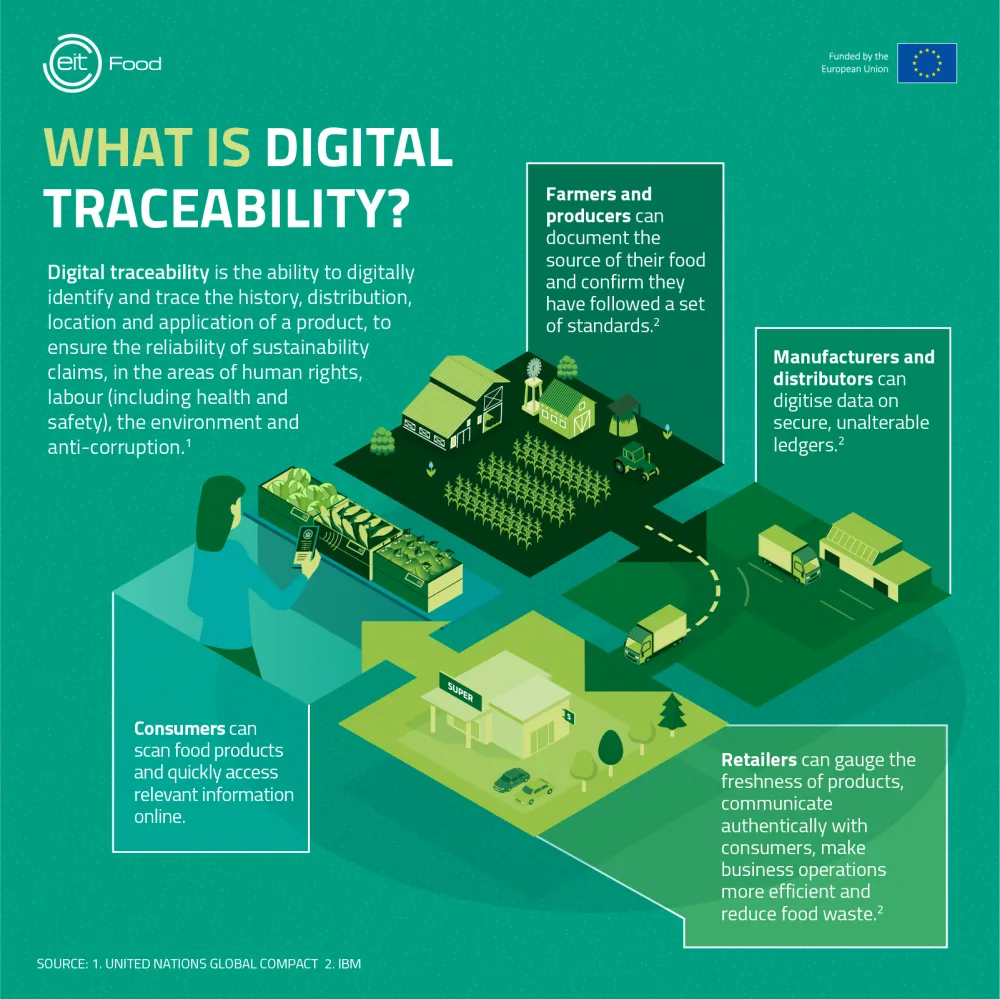

Digital tracking and traceability are becoming essential in petrochemical supply chains. Using blockchain, IoT, and AI, exporters can reduce risks, enhance compliance, and build buyer trust. These tools not only optimize cos . . .