AI-Powered Market Forecasting in Petrochemical Exports: How Data Predicts Prices and Demand

Introduction

In the global petrochemical industry, market forecasting has always been one of the most difficult challenges for exporters. Prices of raw materials like crude oil, fluctuations in freight costs, and geopolitical risks can change export margins overnight. Traditional forecasting methods, often based on historical data and manual analysis, are no longer sufficient.

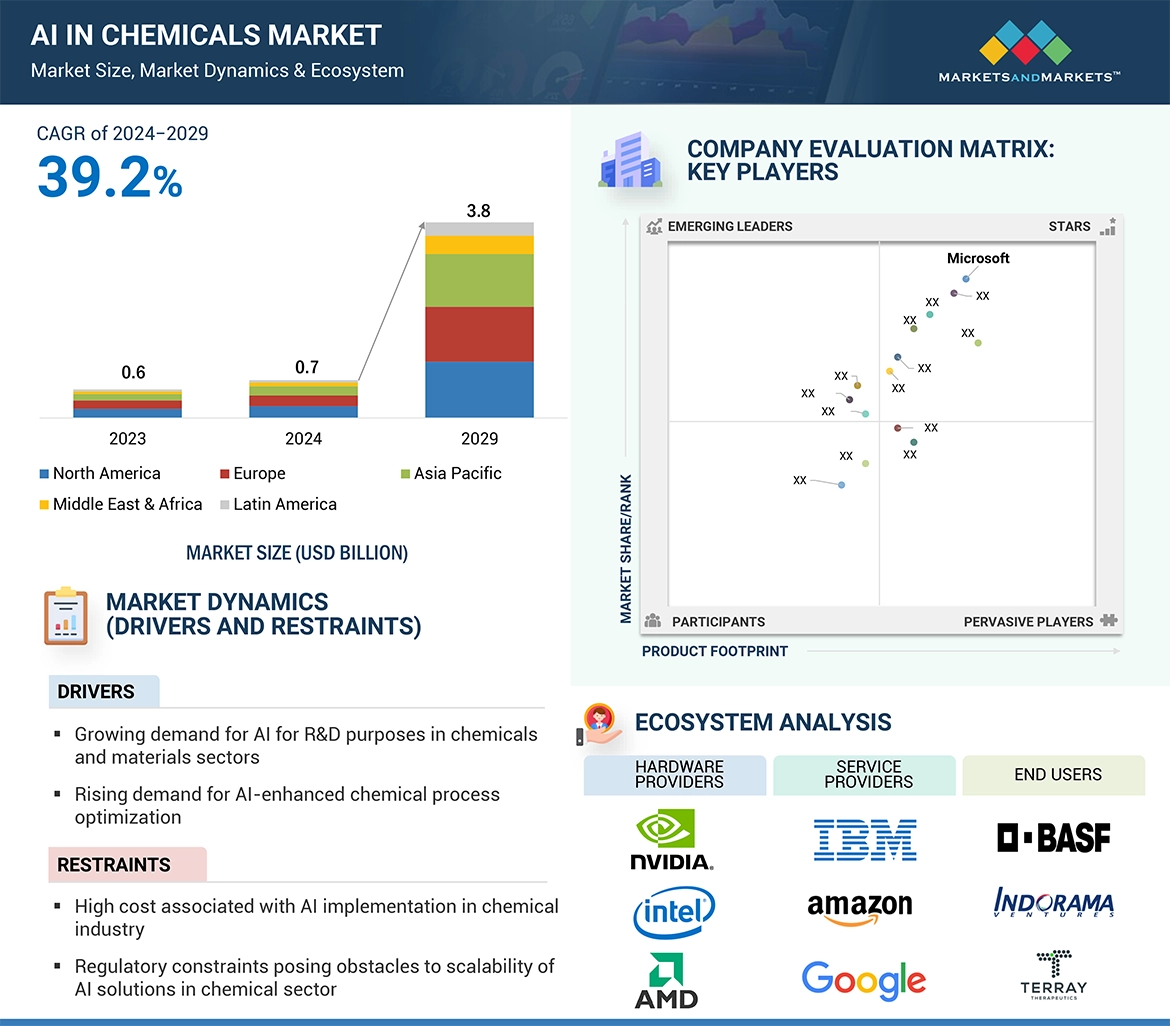

Today, AI in petrochemical trade is transforming how exporters understand global demand and predict future trends. By analyzing massive datasets in real time—from oil prices to shipping routes—AI-driven models give exporters a competitive edge in planning supply, setting prices, and securing profitable contracts.

The Role of AI in Petrochemical Trade

Artificial intelligence is not just about automation; it is about predicting petrochemical prices and anticipating demand before markets react. Machine learning algorithms can:

Analyze Global Energy Prices: Correlating crude oil benchmarks with polymer feedstock costs.

Predict Demand Trends: Identifying shifts in Asia, Africa, and Europe using trade data.

Monitor Shipping and Logistics: Factoring in freight costs, port congestion, and delays.

Integrate Geopolitical Data: Detecting how sanctions, tariffs, or conflicts impact exports.

For exporters of PE100B, base oils, or glycols, this means the ability to see future demand signals before competitors do.

Benefits of AI Forecasting for Exporters

Accurate Demand Planning

AI demand forecasting allows exporters to align production and inventory with expected orders, minimizing both shortages and overstock.Smarter Pricing Strategies

Instead of reactive pricing, exporters can adjust offers in line with predicted crude oil trends and buyer demand cycles.Risk Mitigation

Predictive analytics reduce exposure to sudden freight cost spikes or regional slowdowns.Enhanced Negotiation Power

Exporters with strong data insights can negotiate better terms with buyers and freight forwarders.

Table 1: Key Data Sources Used in AI Forecasting

| Data Source | Relevance to Petrochemical Exports | Example Application |

|---|---|---|

| Crude Oil Benchmarks (Brent, WTI) | Primary driver of polymer feedstock costs | Predicting petrochemical price movements |

| Trade Flow Data (UN/ITC/Customs) | Tracks import/export volumes by region | Identifying growth markets in Asia & Africa |

| Freight & Logistics Data | Shipping costs, port delays, carrier rates | Adjusting export offers for freight surcharges |

| Geopolitical & Regulatory News | Sanctions, tariffs, CBAM, carbon taxes | Anticipating demand shifts in EU & China |

| Weather & Climate Data | Impacts on shipping and energy demand | Planning for seasonal demand changes |

Case Study: AI in Predicting PE100B Export Demand

Consider an Iranian exporter of PE100B resin supplying Turkey, India, and China. Using AI-driven forecasting tools, the company integrates:

Brent crude oil price movements,

regional infrastructure projects,

freight congestion in the Suez Canal,

and demand signals from pipe manufacturing sectors.

The AI system predicts that India’s demand will rise by 12% in Q2 2025, while Turkey may face a slowdown due to tighter regulations. This allows the exporter to divert more cargo to India, lock in long-term contracts, and avoid inventory risk in Turkey.

Table 2: AI vs Traditional Forecasting in Petrochemical Exports

| Aspect | Traditional Forecasting | AI-Powered Forecasting |

|---|---|---|

| Data Sources | Limited (historical, trade reports) | Real-time (oil, freight, geopolitical, climate) |

| Accuracy | Moderate, often lagging | High, predictive, proactive |

| Market Reaction Time | Reactive (after changes occur) | Proactive (anticipates shifts) |

| Exporter Advantage | Low, similar to competitors | High, creates competitive differentiation |

| Scalability | Manual, time-intensive | Automated, scalable across markets |

Future Outlook (2025–2030)

The next decade will see AI fully integrated into petrochemical exports. By 2030, more than 70% of exporters in Asia and the Middle East are expected to rely on petrochemical market forecasting powered by AI. Integration with blockchain will ensure data integrity, while IoT sensors in shipments will feed real-time logistics data into forecasting models.

Exporters who invest early in AI will not just react to markets, but actively shape them—deciding which regions to prioritize and at what prices to secure contracts.

Conclusion

AI in petrochemical trade is no longer optional; it is the foundation of competitive advantage. Exporters who embrace AI demand forecasting can anticipate price shifts, identify new markets, and negotiate better deals. Those who rely on outdated manual forecasting risk losing ground to faster, data-driven competitors.

Would you be able to find suppliers in Iran?

- Contact Us today and get connected with producers and export-ready logistics.

- sales@PetroExportHub.com

Related posts

Mono Ethylene Glycol (MEG) serves as a cornerstone for modern antifreeze and coolant formulations, offering reliable freezing protection and heat resi . . .

Explore Solvent 100’s specs, uses, and export opportunities from Iran. Ideal for paint, ink, and adhesive buyers in India, Turkey, UAE, and Africa. . . .

Explore everything you need to know about exporting sulphur from Iran in 2024 — including types, packaging, documents, ports, prices, and top import . . .

Explore Iran’s top ports for petrochemical exports, including Bandar Imam Khomeini, Assaluyeh, and Bandar Abbas. Compare infrastructure, accessibili . . .

Learn the key differences between polypropylene (PP) and polyethylene (PE), their applications, advantages, and how to choose the right polymer for yo . . .

Discover how a Turkish plastics manufacturer reduced costs by 22% through importing HDPE from Iran. Real-world case study by PetroExportHub. . . .

Learn why Iran is a leading exporter of polyethylene (PE). Discover grades, global applications, and how PetroExportHub connects buyers with top suppl . . .

We are here to answer your questions....

Petro Export Hub

PetroExportHub specializes in the export of premium-grade petrochemicals, minerals, and industrial chemicals from Iran, serving international markets with reliability, transparency, and tailored logistics solutions

Tehran Office

Phone:

+989127607241

Address:

Tehran..

German Office

TEL :

+4915161647487

Address:

Heilsbronne 99441, Nuremberg

Quick Access

Quick Access

- Contact Our Sales Team

- Frequently Questions

- Shipping & Logistics

- Become a Partner

- Certificatins & Quality